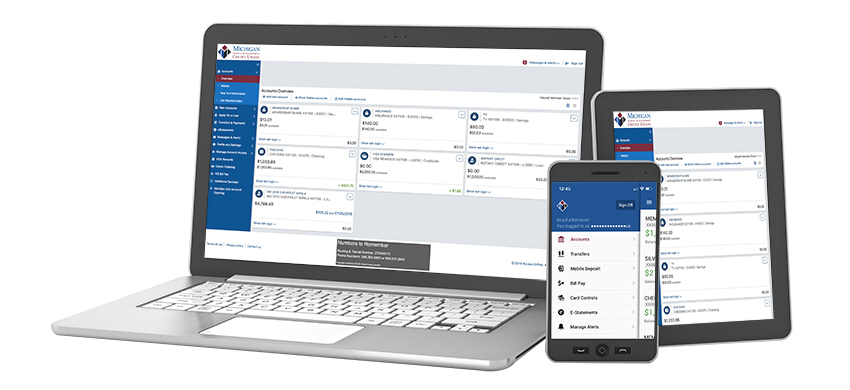

Online and Mobile Banking

Managing your day-to-day finances doesn't always fit within business hours. With a computer or mobile device and our Online Banking tools, you can take care of business any time of the day or night.

Managing your day-to-day finances doesn't always fit within business hours. With a computer or mobile device and our Online Banking tools, you can take care of business any time of the day or night.

The advantages of Online and Mobile Banking go on and on. And all these services are free. Our members can order new checks, view monthly account eStatements, receive account alerts, and export transaction history to financial software. And rest assured, we have state-of-the-art systems to secure our servers and networks, with additional layers of security to safeguard your personal and account information. For specific details, review our security information.

Need help? For your convenience, we've created a growing library of Tutorials and Frequently Asked Questions to help you register and use the system.

Please review our software requirements to use Online and Mobile Banking.

Transfer Money

Easily transfer money between your accounts

or to another member.

Bill Pay

Manage bills by making payments

directly from your checking.

Mobile Deposit

Quickly deposit checks using your mobile device.

Card Controls

Turn your debit and credit cards on and off

for added security.

![]() Take this 5-minute lesson exploring how to use online and mobile banking securely to improve your financial habits and simplify daily financial tasks.

Take this 5-minute lesson exploring how to use online and mobile banking securely to improve your financial habits and simplify daily financial tasks.

For access via Online Banking:

• The following browsers support TLS 1.1 and TLS 1.2 protocols, which are required to securely log into Online Banking: Microsoft Internet Explorer 11+ (Version 9+ is capable but you’ll need to enable TLS 1.1/1.2), Google Chrome Version 22+, Mozilla Firefox Version 27+, Opera Version 12.18+, Safari Version 7+, Android Version 5.0+or another similar Internet Browser that supports SSL encryption, and 128-bit encryption.

• It is important to note: Windows Vista and XP systems that use Internet Explorer as their browser will not have the ability to support TLS 1.1 & 1.2. In order to access Online Banking, you will need to install another browser such as Chrome or FireFox to access Online Banking.

• An IBM-compatible or Apple personal computer, operating system, and tele-communications connections to the Internet that will support the programs mentioned above

• Sufficient electronic storage capacity on your hard drive or other storage medium, or a printer that is capable of printing from your Internet Browser

• An email application that will support HTML formatted emails

For access via Mobile Banking:

• MSGCU’s Mobile Banking App is compatible with iPhone and iPad that are iOS 11.0 or higher, Android devices that are Android OS version 5.0 or higher; and Apple Watch devices that are WatchOS 2 or higher.

• MSGCU’s Mobile Banking App must be downloaded to your device from your preferred app store. Downloading the MSGCU mobile app is free, but your wireless provider’s messaging and data rates may apply.

• Sufficient electronic storage capacity on your hard drive or other storage medium.

• An email application that will support HTML formatted emails.

Need help? Feel free to view our tutorials, stop by a branch, give us a call at 586-263-8800, or chat with us online.

View these quick tutorials to help you register and use our online banking and mobile app.

To register, you’ll need your MSGCU account number. You can find it on your membership card. If you have a loan through us, your loan coupons or your loan origination documents will also have this number.

You’ll set up a username and password, as well as a security phrase and image. Your security phrase can be anything you want it to be. The phrase and image help protect you from scammers that try to get you to log into a fake site and steal your log-in credentials. After registering, if you don’t see the security image and phrase, or it's different from what you entered, don’t log in!

You’ll also set up security questions. These help keep you protected when you try to log in from a new device. You’ll answer a question so we know it’s really you.

Registering for MSGCU's online banking is quick and easy. View video transcript.

Registering for MSGCU's new online and mobile banking is quick and easy using the new MSGCU app on your smartphone. View video transcript.

Watch the videos above, or download and print our instructions.

Logging in to the new system is quick and more secure than ever. Even if you’re logging in on your computer, you can use your smartphone’s fingerprint or facial recognition to help verify your identity with the Quick Login feature. View the video below for instructions to log in and set up Quick Login.

And don’t forget, you first need to register before you log in for the first time.

Logging in is safe and easy using MSGGU's Quick Login feature. View video transcript.

Watch the video above, or download and print our instructions.

Getting around your MSGCU online accounts has never been easier. Here is a quick view around.

Take a tour of MSGCU's online banking. View video transcript.

Take a tour of MSGCU's mobile banking app. View video transcript.

Need to send your friend or family money quickly – and securely? No problem – you can now do this using your MSGCU account. Simply enter their email address or mobile number, choose the amount and send. Your friend will get an email or text letting them know the funds are available and they'll follow the link to receive them.

Sending Money to Friends or Family quickly and easily with MSGCU's Mobile App or Online Banking. View video transcript.

Sending money to friends and family is easy and safe in the MSGCU Mobile App. See video transcript.

You don't need to come to a branch to deposit a check. With Mobile Deposit, depositing a check is quick, easy and safe through MSGCU’s mobile app. Make sure the check is signed on the back with “For Mobile Deposit Only at MSGCU” under your signature. Log in to the app and select Mobile Deposit and follow the prompts.

Video explains how to deposit a check to your MSGCU account with the MSGCU mobile app. View video transcript.

Paying your MSGCU loan from your MSGCU funds just got even easier. Simply choose which account you’re paying from, select your loan, and then choose to pay your regular payment or another amount.

Video shows you how to pay your loan in MSGCU's new online banking. View video transcript.

Video walks you through paying your loan using MSGCU's mobile app. View video transcript.

Setting up alerts and notifications helps you keep track of your accounts automatically.

This video describes how to setting up alerts with MSGCU's new online banking. View video transcript.

You can set alerts for each account you have with us. For example, if you want to know when your checking account goes below $100, you can set that up. You can also customize alerts for your account, for example, anytime you make a change to your contact information, or every time you log in.

Watch the videos above, or download and print our instructions.

Lock and unlock your MSGCU credit or debit cards with ease. See video transcript.

Lock or unlock your credit or debit card with the MSGCU mobile app. View video transcript.

We’ve all experienced the anxiety that comes when you see an empty slot in your wallet where your card normally goes. Now, you can lock, or freeze, your card with a simple click of a button using the new Card Control feature in MSGCU’s online banking. And once you find that card, it’s a simple click to turn it back on. If your card truly is lost or stolen, you can also report it and request a new one.

Transferring money from one MSGCU account to another has never been easier. Simply choose which account you’re transferring from and where it’s going. You can even set up recurring transfers to help you meet your savings goals! Use the same process for paying your MSGCU credit card or even paying your MSGCU loan.

Video shows you how to transfer from one MSGCU account to another. View video transcript.

Video describes how to transfer money from one MSGCU account to another. View video transcript.

Watch the videos above or download and print our instructions.

Do you have more than one MSGCU membership? You can now link your memberships together under one username so you don’t have to log in to each separately. Follow these instructions to link your accounts.

Video walks you through linking multiple MSGCU memberships into one login. View video transcript.

Video describes how to link multiple MSGCU accounts together using MSGCU's mobile app. View video transcript.

MSGCU's new Online Banking is compatible with Quicken's Express Web Connect. This means you can automatically download your MSGCU transactions using Quicken's One Step Update. You can also continue to download your transactions manually if you'd like.

Download our Quicken instructions (includes Quicken for Windows and Quicken for Mac).

Setting up and using QuickBooks with MSGCU's new online banking has never been easier.

Download our QuickBooks instructions (includes QuickBooks for Windows and QuickBooks for Mac).

You can check your balance with the new MSGCU Mobile App without even needing to log in! Watch the tutorial below for instructions to set up and use the convenient Quick Balance feature.

Video walks you through setting up and using MSGCU's Quick Balance feature, which allows you to check your balance without having to log in to the app. View video transcript.

If you use more than one bank or credit union, you can easily transfer funds between your other financial institution and MSGCU. Watch the videos to see how to set this up and how to transfer funds between MSGCU and your other account. You’ll need the routing number and account number of your other account to get started.

Video walks you through linking your MSGCU account with an account from another bank or credit union, also known as external transfers. View video transcript.

Video describes how to link your MSGCU account with your accounts at another bank or credit union, also known as external transfers. View video transcript.

Watch the videos above or download and print our instructions.

When you enroll in eStatements, you'll get access to your statements and important account notices several days sooner than paper ones. They also reduce the chance that someone might gain access to your personal account information by tampering with the mail. Enrolling in eStatements it easy and takes just a few minutes. This video will walk you through how to do that.

This video will show you how to enroll in eStatements through MSGCU's online banking. View transcript.

Enrolling in eStatements is easy and safe in the MSGCU Mobile App. View transcript.

Setting up biometrics allows you to use your phone's facial or finger print recognition to securely access your account.

This video describes how to set up biometrics with MSGCU's mobile app. View video transcript.

Bill Pay is a convenient way to pay all your bills in one place.

And don't forget, we're here to help. Stop by a branch, give us a call at 586-263-8800, or chat with us online.

Simply download our new mobile app or log in to our new online banking. Then, you’re just a few steps away from having easier, more powerful account access at your fingertips.

Need help? Check out our Tutorials and Frequently Asked Questions for help with registering, navigating the new system, and more.

![]() Take this 5-minute lesson exploring how to use online and mobile banking securely to improve your financial habits and simplify daily financial tasks.

Take this 5-minute lesson exploring how to use online and mobile banking securely to improve your financial habits and simplify daily financial tasks.

Members and communities are at the center of everything that we do. You have goals to reach and dreams to achieve, and we are here to help you prosper.