‘Tis the season for increased holiday fraud. Scammers pretend to be MSGCU fraud services and trick victims into sharing their personal information such as account numbers, passwords, social security numbers, and debit or credit card information. The criminals use the stolen information to log in to online banking and make a payment to themselves or make fraudulent card charges.

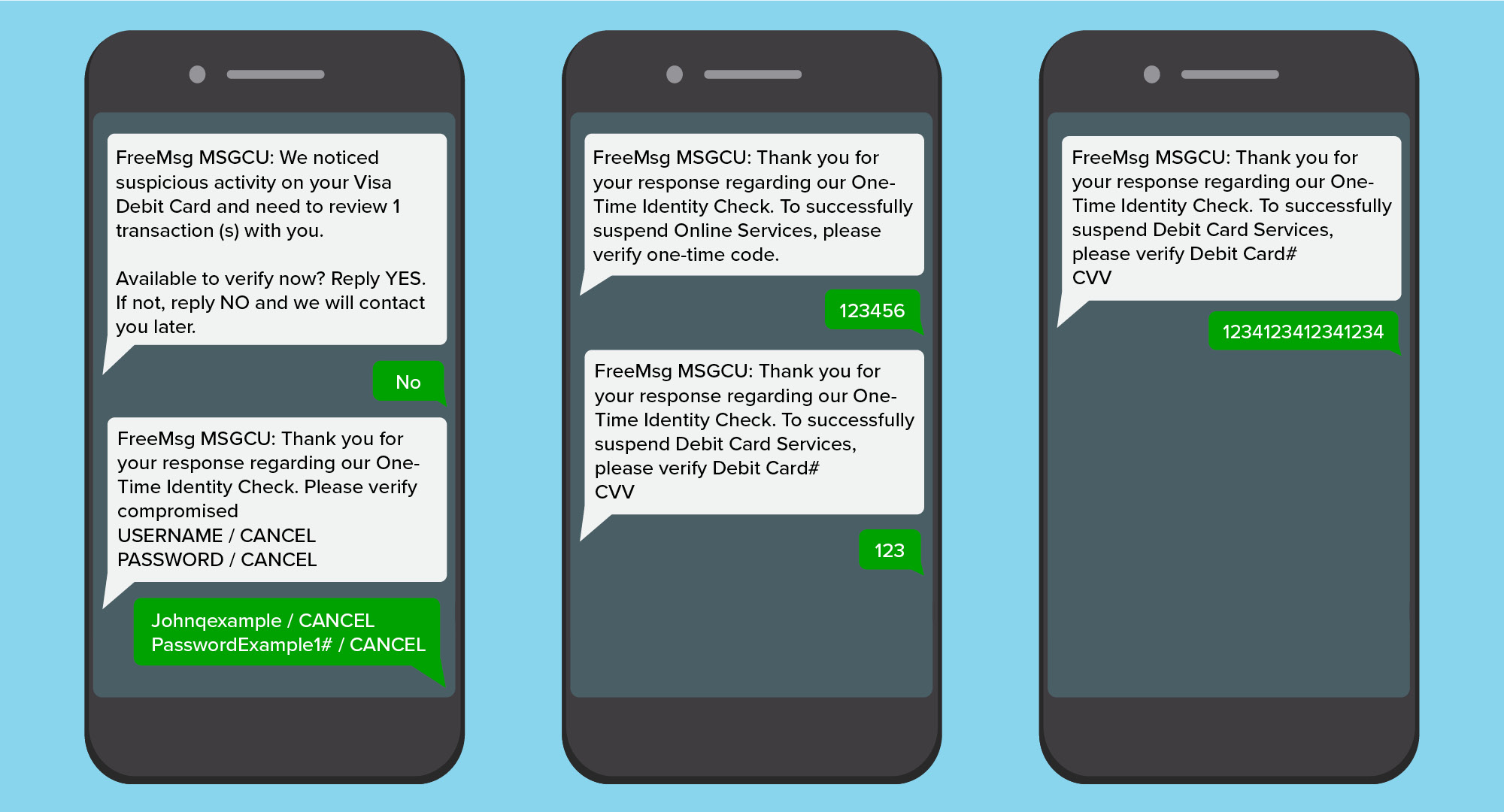

Text messages may say:

Red flags a scammer has contacted you:

- They ask for your online banking username and password and one-time verification pin. MSGCU will NEVER ask for your username and password.

- You receive a call saying your account has been compromised and they need your login credentials to help you.

- The scammer will often keep victims on the phone for a long period of time, sometimes for hours and they may even threaten to lock your account if you hang up.

- You receive a text or email with urgent messaging urging you to click a link to unlock your account. Learn more about phishing scams.

- Fraudsters will insist on staying on the phone with you while you complete transactions online or at a branch and they will tell you what to say.

- After the scammer receives personal information and login credentials, they may instruct you not to log into your account for a specific amount of time.

IMPORTANT: While you may receive a legitimate call or text from our fraud department for unusual activity on your credit or debit card, we will NEVER ask for detailed account information such as your password, one-time verification pin, the 3-digit code on the back of your card, and/or expiration date.

If you receive any communications from a scammer, hang up, do not reply to their texts, and most importantly do not give them any of your information. Contact us at (866) 674-2824 or visit a branch office if your account or identity has been compromised.

Category: Scam Alerts

« Return to "Scam Alerts"