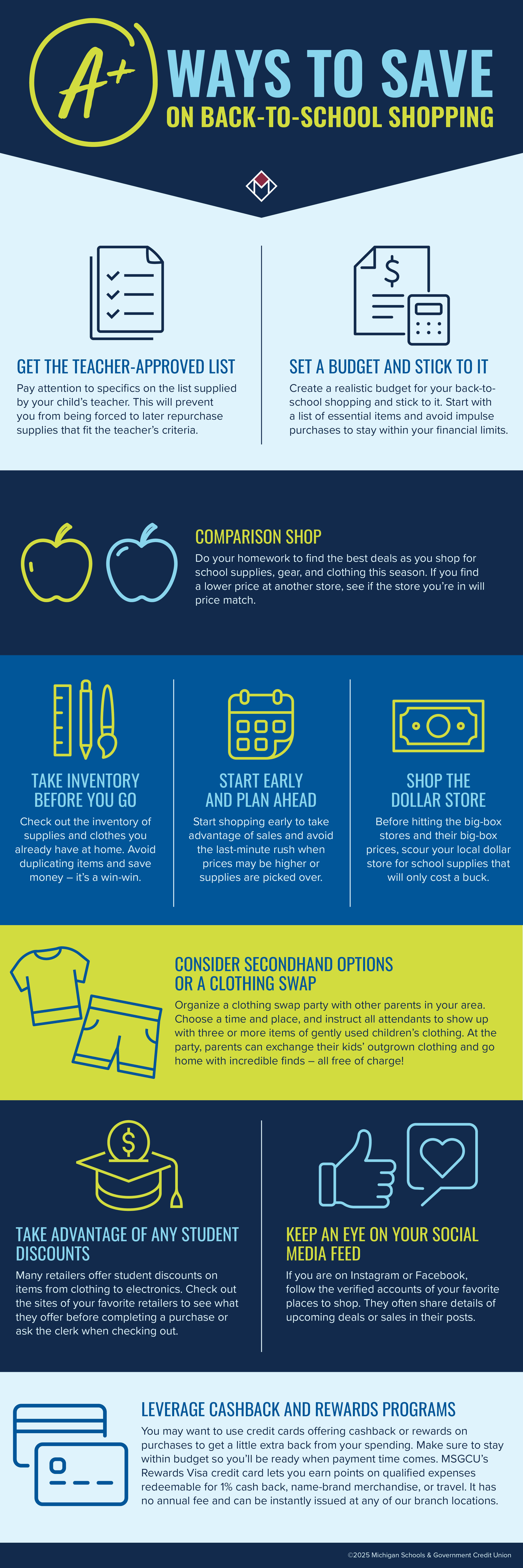

Get the teacher-approved list

Pay attention to specifics on the list supplied by your child’s teacher. This will prevent you from being forced to later repurchase supplies that fit the teacher’s criteria.

Set a budget and stick to it

Create a realistic budget for your back-to-school shopping and stick to it. Start with a list of essential items and avoid impulse purchases to stay within your financial limits.

Comparison shop

Do your homework to find the best deals as you shop for school supplies, gear, and clothing this season. If you find a lower price at another store, see if the store you’re in will price match.

Take inventory before you go

Check out the inventory of supplies and clothes you already have at home. Avoid duplicating items and save money – it’s a win-win.

Start early and plan ahead

Start shopping early to take advantage of sales and avoid the last-minute rush when prices may be higher or supplies are picked over.

Shop the dollar store

Before hitting the big-box stores and their big-box prices, scour your local dollar store for school supplies that will only cost a buck.

Consider secondhand options or a clothing swap

Organize a clothing swap party with other parents in your area. Choose a time and place, and instruct all attendants to show up with three or more items of gently used children’s clothing. At the party, parents can exchange their kids’ outgrown clothing and go home with incredible finds – all free of charge!

Take advantage of any student discounts

Many retailers offer student discounts on items from clothing to electronics. Check out the sites of your favorite retailers to see what they offer before completing a purchase or ask the clerk when checking out.

Keep an eye on your social media feed

If you are on Instagram or Facebook, follow the verified accounts of your favorite places to shop. They often share details of upcoming deals or sales in their posts.

Leverage cashback and rewards programs

You may want to use credit cards offering cashback or rewards on purchases to get a little extra back from your spending. Make sure to stay within budget so you’ll be ready when payment time comes. MSGCU’s Rewards Visa credit card lets you earn points on qualified expenses redeemable for 1% cash back, name-brand merchandise, or travel. It has no annual fee and can be instantly issued at any of our branch locations.

Category: Finance

« Return to "Blog"

You May Also Like

Using Your Home's Value: A Guide to Home Equity Loans and HELOCs

If you’re looking to tap into your home’s equity, you have two great choices in a Home Equity Line of Credit (HELOC) and a Home Equity loan (HE). Learn more about these two options, their key features, and factors to consider before deciding which is right for you.

Keeping your car covered: What to do to keep your loan from outliving your car

Situations such as thefts, accidents, and wear and tear may make your auto loan last longer than your car. Here are some tips to help so you won’t find yourself with a loan and without a car.

Your emergency savings account can help you weather life’s storms

Are you one of the millions of Americans who are concerned there’s not enough money in their savings to cover an unexpected expense? September is National Preparedness Month, and it’s an ideal time to start building your emergency savings.

Put your home’s equity to work for you this summer.

The hot real estate market has led to a boom in popularity for home equity loans with many Michiganders choosing to stay in their home purchased or refinanced when mortgage rates were historically low. Read on to learn what a home equity loan is, what you can use it for, and see if it’s right for you.

5 Ways to Increase Your Credit Score

Your credit score is vital to your financial health. An excellent credit score can open the door to large loans and better interest rates, as well as employment opportunities and more.

Discover the best ways to build and maintain an excellent credit score.

Payday Loans: A Serious Problem with A Smart Solution

Payday loans can seem like an easy way out of a financial jam, until you get caught in the spiral of fees. Fortunately, MSGCU has you covered when unexpected needs arise and you’re out of funds until the next pay day.

How To Make Certificates of Deposit Work for You and Your Savings Goals

Is building your savings account a priority in your financial goals? Learn more about your options and determine the right choice for you when it comes to savings accounts and certificates of deposit.

Beyond the piggy bank: 5 ideas for helping kids achieve more financial independence.

Teaching kids about money management can seem daunting, but it doesn’t have to be complicated. Read on for five simple money truths to help prepare your kids for a successful financial future.

Six smart financial moves to make when you get your first “real” job.

Your hard work has paid off and you’ve landed your first “real” job. Congratulations! As you embark on your brilliant career, you can make your future even brighter by making these smart financial moves.

Applying for a new mortgage? We have tips to save you time.

Whether you are a first-time home buyer or reentering the home buying or refinancing market, the application process might seem daunting. Before you start emptying your filing cabinet for documents, see how you can streamline the application process.

8 questions to ask before taking out an auto loan

Whether you’re buying or refinancing, choosing an auto lender is a big decision. Take your time to find one who will work with you and your financial goals; in other words, do your homework. Read on for 8 key questions to ask lenders before you get (or refinance) an auto loan.

Membership Status

New to MSGCU?

It's simple and secure to open an MSGCU membership online. Our application usually takes less than 10 minutes and you can fund your new account right away.

Apply & JoinAlready a member?

Simply log in to Online Banking and select New Accounts. You can open Savings and Checking accounts, as well as CDs, in just a matter of minutes.

Log in & Open